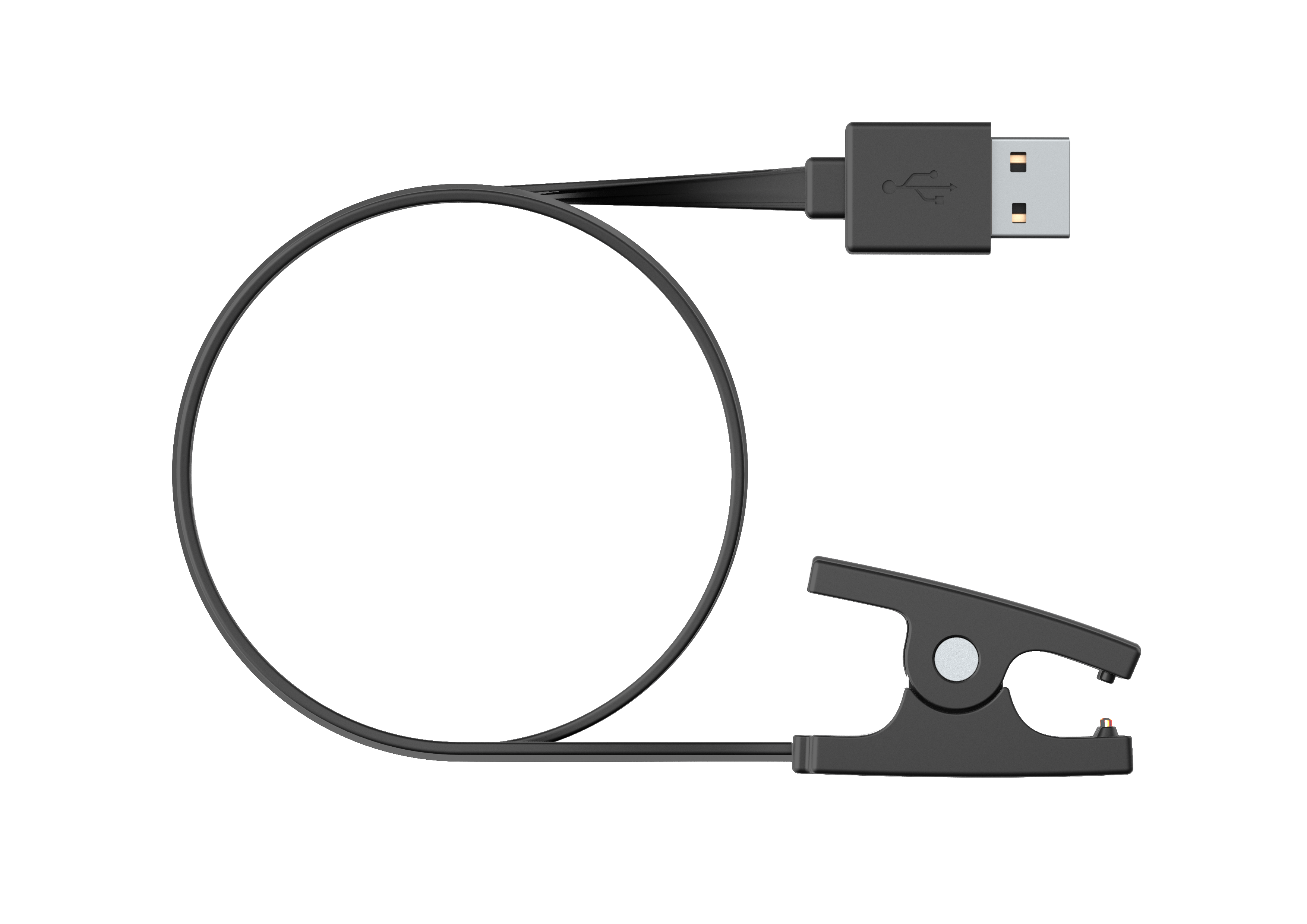

Amazon.com: Charger for Suunto Ambit, Power Cable for Suunto Ambit/Ambit2/S/ Ambit 3 Run Sports Watch and GPS Track Pod Watch Replacement USB Charge Charging Cable Wire Cord Dock Clip Data Sync for SUUNTO :

Amazon.com: Charger for Suunto Ambit, Power Cable for Suunto Ambit/Ambit2/S/ Ambit 3 Run Sports Watch and GPS Track Pod Watch Replacement USB Charge Charging Cable Wire Cord Dock Clip Data Sync for SUUNTO :

2X Charger For Suunto Ambit,Power Cable For Suunto Ambit/Ambit2/Ambit2 S/ Ambit 3 Sports Watch And Gps Track Pod Watch - AliExpress

Amazon.com: TUSITA Charger Compatible with Suunto 3 Fitness,Suunto 5, Traverse, Kailash, Spartan Trainer, Ambit 1 2 3 - USB Charging Cable 100cm - Smartwatch Accessories : Cell Phones & Accessories

OIAGLH 2Pcs 3.3Ft USB Charging Cable Cradle Dock Charger For Suunto 3 Fitness,Suunto 5,Ambit 1 2 3,Traverse,Kailash - Newegg.com

New 1m USB Charger Magnetic Cable For Suunto Ambit 3 Smart Watch Fast Charge Clip Adapter Replacement High quality Watch charger - AliExpress

Watch Charger For Suunto Ambit 1/2/3 Smart Watch Fast Charging Adapter USB Charger Cable For Suunto Ambit 1/2/3

Watch Charger For Suunto Ambit 1/2/3 Smart Watch Fast Charging Adapter USB Charger Cable For Suunto Ambit 1/2/3

Amazon.com: Charger for Suunto Ambit, Power Cable for Suunto Ambit/Ambit2/S/ Ambit 3 Run Sports Watch and GPS Track Pod Watch Replacement USB Charge Charging Cable Wire Cord Dock Clip Data Sync for SUUNTO :

USB Charging Clip Adapter Safety Fast Cable Charger For Suunto 5 3 Ambit 1 2 Spartan Trainer Traverse Kailash Core Smart Watch - AliExpress

USB Cable Charger for Suunto Ambit/Ambit2/Ambit2 S/Ambit 3, Power Cable for Suunto Run Sports Watch Replacement USB Charge Charging Cable Wire Cord Dock Clip Data Sync for SUUNTO - Walmart.com

USB Charger For Suunto 5 Charging Cable Clip For Suunto 3 Fitness/Spartan Trainer/Ambit 123/Traverse/Kailash 1M Watch Adapter - AliExpress

Charger Usb Magnetic Cable For Suunto Ambit 1/2/3 Smart Watch Fast Charge Clip Adapter Replacement High quality Watch charger - AliExpress

USB Charger For Suunto 5 Charging Cable Clip For Suunto 3 Fitness/Spartan Trainer/Ambit 123/Traverse/Kailash 1M Watch Adapter - AliExpress